Property Tax In Kansas For Cars . For your property tax amount, use our motor vehicle. you will pay property tax when you initially register a vehicle and each year when you renew your vehicle registration. if you have delinquent personal property taxes in any county in kansas, they must be paid before vehicles can be tagged. Vehicle property tax is due annually. How to use the kansas vehicle tax calculator: To use this calculator, follow these steps: kansas department of revenue division of vehicles home page. Kansas’ 105 county treasurers handled vehicle, registration, tags and renewals. title and tag fee is $10.50. You pay property tax when you initially title and register a. vehicle tags, titles and registration. Click on the link below, click the resources for states tab and scroll down to view.

from www.wichitaliberty.org

kansas department of revenue division of vehicles home page. How to use the kansas vehicle tax calculator: if you have delinquent personal property taxes in any county in kansas, they must be paid before vehicles can be tagged. You pay property tax when you initially title and register a. you will pay property tax when you initially register a vehicle and each year when you renew your vehicle registration. Click on the link below, click the resources for states tab and scroll down to view. Kansas’ 105 county treasurers handled vehicle, registration, tags and renewals. For your property tax amount, use our motor vehicle. vehicle tags, titles and registration. Vehicle property tax is due annually.

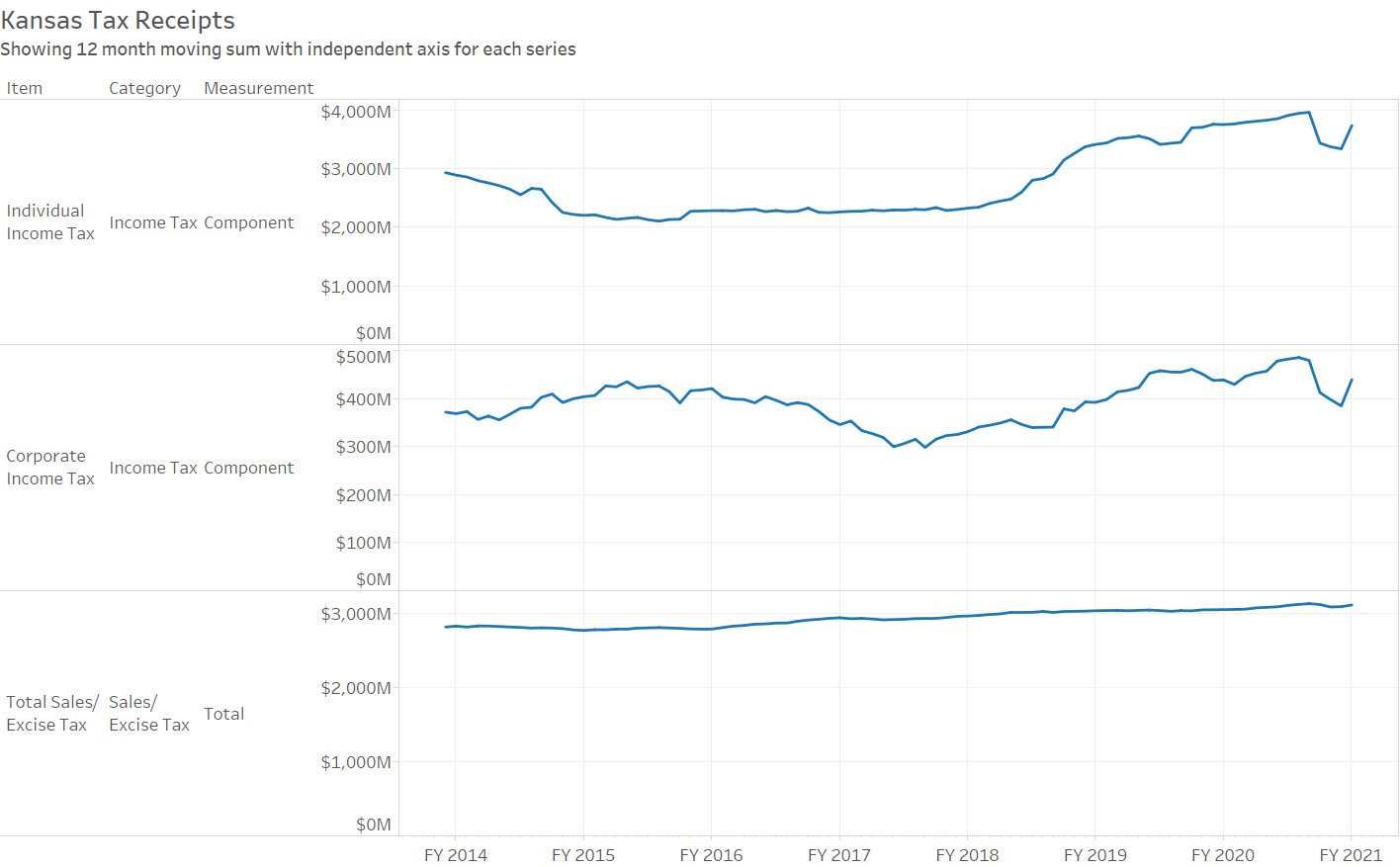

Kansas tax revenue, July 2020

Property Tax In Kansas For Cars To use this calculator, follow these steps: kansas department of revenue division of vehicles home page. To use this calculator, follow these steps: if you have delinquent personal property taxes in any county in kansas, they must be paid before vehicles can be tagged. Vehicle property tax is due annually. you will pay property tax when you initially register a vehicle and each year when you renew your vehicle registration. Kansas’ 105 county treasurers handled vehicle, registration, tags and renewals. vehicle tags, titles and registration. You pay property tax when you initially title and register a. For your property tax amount, use our motor vehicle. title and tag fee is $10.50. Click on the link below, click the resources for states tab and scroll down to view. How to use the kansas vehicle tax calculator:

From www.youtube.com

Kansas property taxes have gone up 300 million in three years YouTube Property Tax In Kansas For Cars you will pay property tax when you initially register a vehicle and each year when you renew your vehicle registration. title and tag fee is $10.50. Vehicle property tax is due annually. To use this calculator, follow these steps: Click on the link below, click the resources for states tab and scroll down to view. How to use. Property Tax In Kansas For Cars.

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills Property Tax In Kansas For Cars Click on the link below, click the resources for states tab and scroll down to view. For your property tax amount, use our motor vehicle. title and tag fee is $10.50. You pay property tax when you initially title and register a. To use this calculator, follow these steps: vehicle tags, titles and registration. kansas department of. Property Tax In Kansas For Cars.

From www.formsbank.com

Fillable Form K40pt Kansas Property Tax Relief Claim For Low Property Tax In Kansas For Cars Click on the link below, click the resources for states tab and scroll down to view. kansas department of revenue division of vehicles home page. Vehicle property tax is due annually. To use this calculator, follow these steps: vehicle tags, titles and registration. title and tag fee is $10.50. you will pay property tax when you. Property Tax In Kansas For Cars.

From prorfety.blogspot.com

PRORFETY How Much Is Property Tax In Kansas For A Car Property Tax In Kansas For Cars For your property tax amount, use our motor vehicle. Vehicle property tax is due annually. vehicle tags, titles and registration. How to use the kansas vehicle tax calculator: if you have delinquent personal property taxes in any county in kansas, they must be paid before vehicles can be tagged. Click on the link below, click the resources for. Property Tax In Kansas For Cars.

From www.carsalerental.com

Kansas Sales Tax On Car Purchase Car Sale and Rentals Property Tax In Kansas For Cars For your property tax amount, use our motor vehicle. title and tag fee is $10.50. You pay property tax when you initially title and register a. To use this calculator, follow these steps: you will pay property tax when you initially register a vehicle and each year when you renew your vehicle registration. How to use the kansas. Property Tax In Kansas For Cars.

From my-unit-property-9.netlify.app

Real Estate Property Tax By State Property Tax In Kansas For Cars you will pay property tax when you initially register a vehicle and each year when you renew your vehicle registration. title and tag fee is $10.50. Click on the link below, click the resources for states tab and scroll down to view. You pay property tax when you initially title and register a. Kansas’ 105 county treasurers handled. Property Tax In Kansas For Cars.

From nickolasallman.blogspot.com

Nickolas Allman Property Tax In Kansas For Cars To use this calculator, follow these steps: How to use the kansas vehicle tax calculator: For your property tax amount, use our motor vehicle. kansas department of revenue division of vehicles home page. you will pay property tax when you initially register a vehicle and each year when you renew your vehicle registration. if you have delinquent. Property Tax In Kansas For Cars.

From nickmassagroup.com

Property Taxes In Johnson County, KS [Made Simple] Property Tax In Kansas For Cars Click on the link below, click the resources for states tab and scroll down to view. title and tag fee is $10.50. vehicle tags, titles and registration. you will pay property tax when you initially register a vehicle and each year when you renew your vehicle registration. if you have delinquent personal property taxes in any. Property Tax In Kansas For Cars.

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills Property Tax In Kansas For Cars You pay property tax when you initially title and register a. if you have delinquent personal property taxes in any county in kansas, they must be paid before vehicles can be tagged. kansas department of revenue division of vehicles home page. Vehicle property tax is due annually. you will pay property tax when you initially register a. Property Tax In Kansas For Cars.

From kansaspolicy.org

5 things you need to know about property taxes in Kansas Kansas Property Tax In Kansas For Cars How to use the kansas vehicle tax calculator: You pay property tax when you initially title and register a. if you have delinquent personal property taxes in any county in kansas, they must be paid before vehicles can be tagged. To use this calculator, follow these steps: Vehicle property tax is due annually. vehicle tags, titles and registration.. Property Tax In Kansas For Cars.

From statesalestaxtobitomo.blogspot.com

State Sales Tax Kansas State Sales Tax Rates Property Tax In Kansas For Cars if you have delinquent personal property taxes in any county in kansas, they must be paid before vehicles can be tagged. How to use the kansas vehicle tax calculator: For your property tax amount, use our motor vehicle. title and tag fee is $10.50. vehicle tags, titles and registration. Kansas’ 105 county treasurers handled vehicle, registration, tags. Property Tax In Kansas For Cars.

From www.lamansiondelasideas.com

Kansas Lawmakers Considering Real Estate Property Taxes Reform Property Tax In Kansas For Cars Kansas’ 105 county treasurers handled vehicle, registration, tags and renewals. For your property tax amount, use our motor vehicle. vehicle tags, titles and registration. You pay property tax when you initially title and register a. if you have delinquent personal property taxes in any county in kansas, they must be paid before vehicles can be tagged. To use. Property Tax In Kansas For Cars.

From kansaspolicy.org

Kansas has some of the nation’s highest property tax rates Kansas Property Tax In Kansas For Cars Click on the link below, click the resources for states tab and scroll down to view. For your property tax amount, use our motor vehicle. To use this calculator, follow these steps: kansas department of revenue division of vehicles home page. you will pay property tax when you initially register a vehicle and each year when you renew. Property Tax In Kansas For Cars.

From topforeignstocks.com

Property Taxes by State Chart Property Tax In Kansas For Cars title and tag fee is $10.50. vehicle tags, titles and registration. To use this calculator, follow these steps: How to use the kansas vehicle tax calculator: you will pay property tax when you initially register a vehicle and each year when you renew your vehicle registration. You pay property tax when you initially title and register a.. Property Tax In Kansas For Cars.

From itep.org

Kansas Who Pays? 7th Edition ITEP Property Tax In Kansas For Cars Vehicle property tax is due annually. you will pay property tax when you initially register a vehicle and each year when you renew your vehicle registration. How to use the kansas vehicle tax calculator: title and tag fee is $10.50. if you have delinquent personal property taxes in any county in kansas, they must be paid before. Property Tax In Kansas For Cars.

From www.wichitaliberty.org

Kansas tax revenue, July 2020 Property Tax In Kansas For Cars You pay property tax when you initially title and register a. Click on the link below, click the resources for states tab and scroll down to view. if you have delinquent personal property taxes in any county in kansas, they must be paid before vehicles can be tagged. kansas department of revenue division of vehicles home page. . Property Tax In Kansas For Cars.

From kansaspolicy.org

Kansas has some of the nation’s highest property tax rates Kansas Property Tax In Kansas For Cars you will pay property tax when you initially register a vehicle and each year when you renew your vehicle registration. How to use the kansas vehicle tax calculator: kansas department of revenue division of vehicles home page. Vehicle property tax is due annually. vehicle tags, titles and registration. Click on the link below, click the resources for. Property Tax In Kansas For Cars.

From forms.legal

General Bill of Sale Kansas Download Printable Form Format Property Tax In Kansas For Cars title and tag fee is $10.50. kansas department of revenue division of vehicles home page. Click on the link below, click the resources for states tab and scroll down to view. vehicle tags, titles and registration. For your property tax amount, use our motor vehicle. To use this calculator, follow these steps: if you have delinquent. Property Tax In Kansas For Cars.